INTELLIGENT BIO SOLUTIONS (INBS)·Q2 2026 Earnings Summary

Intelligent Bio Solutions Posts 48% Revenue Growth as Reader Sales Double

February 5, 2026 · by Fintool AI Agent

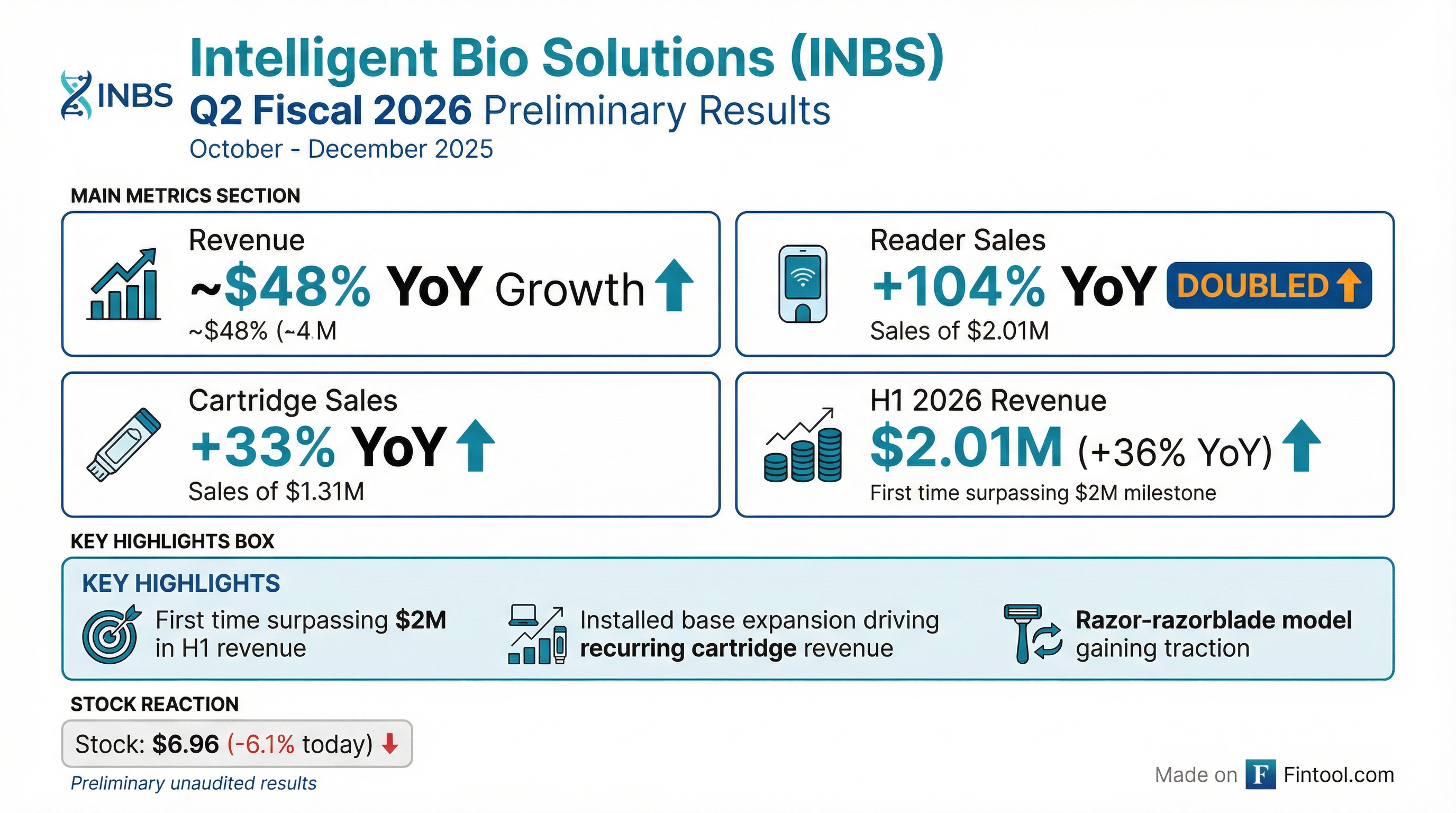

Intelligent Bio Solutions (NASDAQ: INBS) announced preliminary, unaudited revenue results for fiscal Q2 2026 (October-December 2025), reporting approximately 48% year-over-year revenue growth . The company expects to surpass $2 million in total revenue for the first half of fiscal 2026, a significant milestone for the emerging medical technology company .

Did INBS Beat Earnings?

No analyst coverage available. INBS is a micro-cap company (~$4.5M market cap) with no sell-side analyst coverage. Without consensus estimates, there is no formal "beat" or "miss" to report.

However, the preliminary results show strong execution on the company's growth strategy:

*Estimated based on 48% growth from Q2 2025 revenue of $607K

For the six-month period (H1 2026), the company expects total revenue of approximately $2.01 million, a 36% increase year-over-year .

What's Driving the Growth?

CEO Harry Simeonidis highlighted the razor-razorblade business model as the foundation for sustainable growth:

"This expansion of our installed base is the foundation of our razor-razorblade business model, as each reader placement creates a long-term relationship that drives recurring cartridge revenue."

Key growth drivers:

- Reader Sales Doubled (+104% YoY): The company is aggressively expanding its installed base of drug screening readers

- Cartridge Momentum (+33% YoY): Reflects both new customer adoption and ongoing consumable demand from existing installed base

- Accessories/Training (+36% YoY): Supporting revenue stream growing alongside core products

How Did the Stock React?

The stock fell 6.1% today, closing at $6.96 on 142K volume — elevated compared to average trading.

The negative reaction appears disconnected from the strong preliminary results. Possible explanations:

- Profit-taking: Stock had run significantly in prior months

- Micro-cap volatility: Low float leads to exaggerated moves

- Preliminary nature: Investors may wait for final audited results

What Changed From Last Quarter?

Comparing Q2 2026 to Q1 2026 and the year-ago quarter:

The sequential decline from Q1 to Q2 is notable but may reflect seasonality. The year-over-year trend remains strongly positive across all product categories.

Historical Revenue Trend:

The Razor-Razorblade Model in Action

INBS's Intelligent Fingerprinting Drug Screening System operates on a classic razor-razorblade model:

- Readers (razors): Upfront hardware placement creates long-term customer relationships

- Cartridges (razorblades): Consumables generate recurring revenue

The 104% growth in reader sales is strategically important — each new reader creates an ongoing revenue stream from cartridge refills. The 33% growth in cartridge sales demonstrates this model is working, with existing customers continuing to purchase consumables .

Financial Position

As of December 31, 2024 (most recent disclosed):

The company continues to operate at a loss while investing in growth and regulatory approvals. Cash position will be a key metric to watch in the full Q2 2026 filing.

Forward Catalysts

- Full Q2 2026 Results: Expected to be filed in Form 10-Q during the week of February 9, 2026

- FDA 510(k) Decision: The company submitted its FDA 510(k) pre-market notification in December 2024 and received clearance would unlock the multi-billion dollar U.S. market

- U.S. Market Entry: Planned expansion contingent on FDA approval

- Installed Base Growth: Continued reader placement will drive future cartridge revenue

Key Risks

- Cash Burn: Net losses of ~$2-3M per quarter with limited cash runway

- Micro-Cap Liquidity: Low float leads to volatile trading

- FDA Dependency: U.S. market entry hinges on regulatory approval

- Preliminary Results: Final audited numbers may differ from today's announcement

What Management Avoided

The preliminary announcement focused on topline revenue metrics and did not address:

- Gross margin performance for Q2 2026

- Operating expenses or net loss expectations

- Cash position as of December 31, 2025

- FDA 510(k) review status or timeline update

- Customer acquisition metrics or account count

Full financial details expected in the 10-Q filing next week.

Related Links: